Proof-of-work (PoW) blockchains like Bitcoin are limited in what they can do, but the Polkadot blockchain can transfer any asset or data between blockchains, can handle more transactions per second, and needs less infrastructure.

Polkadot uses a nominated proof-of-stake (NPoS) blockchain that is based on the interoperability of parachains that connect to the Relay Chain and are protected by it. Validators can check both the Relay Chain and the parachains, so this blockchain solution is flexible and scalable.

DOT is the name of the token that is used on the Polkadot blockchain (DOT). On the Polkadot network, it can be used to trade, stake, bond, pay transaction fees, and vote on how the network is run.

This article explains what Polkadot staking is, how it works, how to stake DOT, its requirements and rewards, and why DOT token holders should stake DOT.

How does polkadot staking work and what is it?

Polkadot is a blockchain project that was started in 2016 as a layer-0 protocol and multichain network. It was started by Gavin Wood, who also helped start Ethereum.

The goal of the project is to make a decentralized, safe, and fair internet called Web 3.0, or Web3, by making it easier for previously separate and incompatible blockchain networks to talk to each other.

In Polkadot staking, you nominate validators by giving them DOT tokens in exchange for rewards. Polkadot is an NPoS blockchain that relies on nodes to verify transactions and keep its network safe. The NPoS mechanism is a complex system where nominators choose the validators who can take part in the consensus protocol. In general, a network with more participants and more distributed nodes is more decentralized, making it less likely that hackers will be able to attack the blockchain successfully.

DOT holders can use the Polkadot staking system in four main ways, depending on how much time they have, how much knowledge they have, and how much money they have. Takers who don’t have the minimum amount needed to nominate themselves (which changes) can join a nomination pool and share all benefits and penalties in an equal way.

Stakeholders can also choose validators. Takers often choose a validator based on how well they can check if network transactions are legitimate. Stakeholders, on the other hand, can open and run a nomination pool if they are sure they can find qualified and trustworthy validators and ask for a commission. People can join and put their cryptocurrency on the line.

At the top are the validators, which are best for people with a lot of time and technical knowledge. These people are in charge of the nodes, which are servers with special software that can accept or reject a block of transactions.

Before Polkadot lets anyone become a validator, they must meet a strict set of staking requirements. This is because validators need specialized skills and will be in charge of a master node.

People who stake with a validator get more Polkadot tokens if the validator checks a transaction correctly. If a validator approves a fraudulent transaction or tries to cheat the system, they and their nominators will lose a portion of the DOT they have staked. Any DOTs that are cut off will go into the Polkadot Treasury.

There are also specialized jobs that require more technical knowledge than being a nominator but less commitment than being a validator. There are also members of the Polkadot Alliance and collators. Collators keep track of valid parachain transactions and send them to validators on the Relay Chain.

DOT requirements for staking

To stake and nominate directly, users will need a minimum amount of DOT that will change over time. This rule doesn’t apply when users join a nomination pool, use a liquid staking method, or use an exchange because they give their power to validators who meet minimum requirements.

A platform for exchanging currencies may have other rules, such as Know Your Customer/Anti-Money Laundering, minimum stake amounts, minimum lockup periods, or fees.

Why stake Polkadot

Staking DOT is a way to make the network safer and less centralized and to earn staking rewards. In exchange for DOT, people who stake DOT help keep the network stable, growing, and safe.

Stakers can even use the tokens they have staked to make passive income that could grow as the ecosystem grows. Participants in the Polkadot ecosystem get to help run the network and benefit from the token’s rising value.

How to stake Polkadot (DOT)?

DOT holders can help run the network by staking their tokens and getting more DOT tokens in return.

Most people stake DOT through a cryptocurrency exchange, a hardware wallet, the Polkadot app, or the network’s Polkadot.js user interface (UI).

1. Using Polkadot.js UI

Using the Polkadot.js user interface, staking can be done as either a validator or a nominee. On the Polkadot platform, people who are nominated can suggest up to 16 prospects for validators. Validators run nodes on the Polkadot network and make sure that it is safe and reliable.

There are rewards for both the validators and the nominators. The amount of rewards the nominators get depends on how the validators act. In short, the rewards for validators and those who nominate them go up the better the validator does.

Here are the steps to nominate a validator using the Polkadot.js UI or the Polkadot app:

- Create a Polkadot account.

- Navigate and select the “Network > Staking > Accounts page” tab.

- Click “+ Nominator.”

- Choose a stash and controller account.

- Enter the amount to bond.

- Choose a desired validator.

2. You can vote for yourself or join a nomination pool.

Native staking is one of the easiest ways to stake DOT, and users can either stake directly as a nominee or join a nomination pool. On the Polkadot website, there is a page that goes into detail about this process.

3. Using an exchange for cryptocurrency

This method is getting more and more popular because it is easy to stake in a staking pool on a cryptocurrency exchange. Users buy DOT tokens on the exchange of their choice, add them to their Polkadot wallet, and click the stake button to start staking.

DOT tokens can be bought with cash or cryptocurrency. Then, they put the tokens into the exchange account or, if they already have a Polkadot wallet, directly into it. When DOT tokens are put into the Polkadot platform, they can earn big rewards with little work from the stakers.

Kraken, Binance, Coinbase, KuCoin, and Crypto.com are all examples of staking platforms.

Staking on an exchange can be convenient, but it also comes with its own problems:

- Lack of control over private keys: When staking with an exchange, users are not in control of their private keys. This means that they have to rely on the exchange’s practices and security measures.

- Reduced staking rewards: Exchanges usually take a percentage of the staking rewards as a fee for their services. This means that users will earn less than they would if they were staking independently.

- Increased risk of hacks and exploits: As more people stake with a particular exchange, the exchange’s wallet grows, giving it more voting power and potentially centralizing the blockchain network. This also makes it a more attractive target for hackers and other bad actors who may try to exploit vulnerabilities in the exchange’s security.

4. Putting money in a wallet

Using a wallet to stake DOT is more complicated than using a cryptocurrency exchange. When a wallet is used, the only thing between a staker and their rewards is the chosen validator.

Before users can start to stake, they have to choose up to 16 validators. Stakeholders should look carefully at their validators before choosing the wallet method. Before choosing a validator or staking service, they should also think about the provider’s security, dependability, and track record.

To start staking with a wallet, a staker must first get some DOT from an exchange and put it into a DOT wallet. There are a number of wallets where you can stake DOT, including:

- Ledger

- Polkadot.js

- Talisman

- Fearless

- Subwallet

- Nova

- Polkawallet

Users should choose their DOT wallet based on how much DOT they want to stake and what they want to do with it.

Hardware wallets, which are also called “cold wallets” because they store and back up private keys offline, are the safest alternative. Hardware wallets, on the other hand, are usually harder to learn how to use and cost more. Ledger is the only hardware wallet that works with DOT.

Users can also choose a software wallet, which is easy and free to use. Software wallets are easy to use, but they are not as safe as hardware wallets. So, they might be better for storing less DOT or for people who haven’t used them before.

DOT staking rewards

Every 24 hours, delegators and stakers get Polkadot staking rewards based on how many blocks their stake helped make. Polkadot is likely to give better returns than other proof-of-stake blockchains and exchange staking.

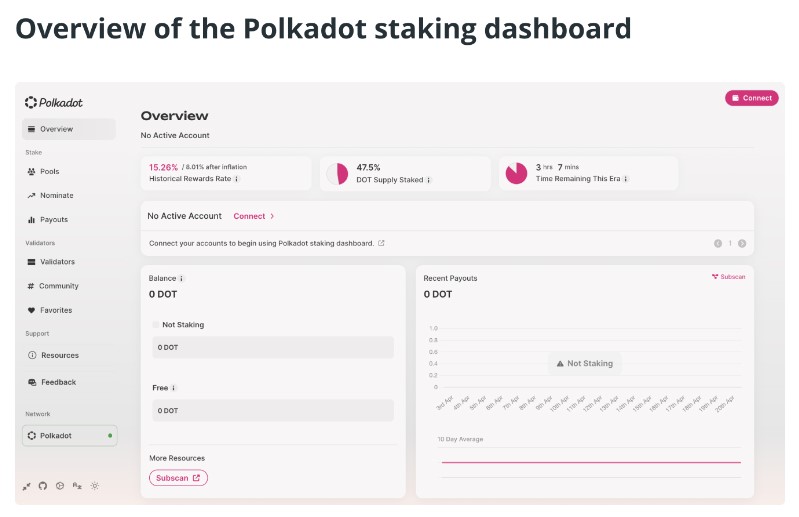

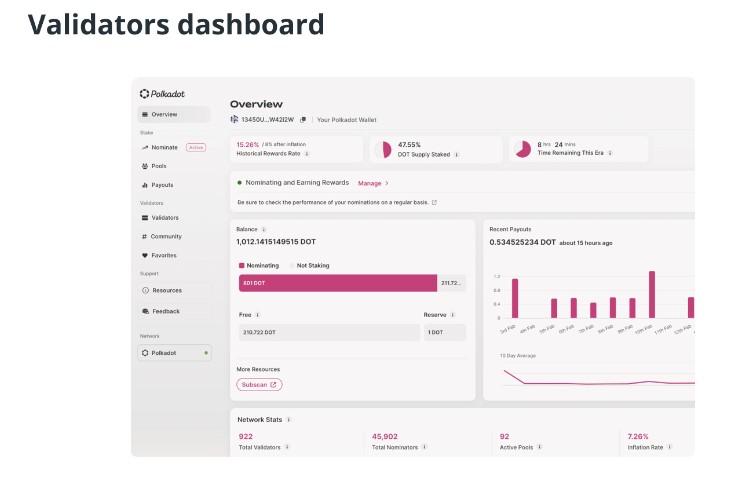

Staking Rewards, a company that collects information about crypto-staking, says that the annual reward rate that Polkadot holders can get depends on the wallet, the crypto-trading platform, and the validators. The most a holder can earn in rewards each year is 14.34%. The staking dashboard on Polkadot shows on-chain data about current rewards.

In the same way, there are different rewards for staking DOT tokens based on how they are staked. Nominators who don’t run the nodes themselves but instead give the stakes to validators can earn a maximum annual reward rate of 14.1%. Because validator node operators also have to take care of the network, they might make up to 14.8% more than other node operators.

How dangerous is it to bet on Polkadot?

Investing in Polkadot comes with its own set of risks, just like investing in anything else. Even though it has a good annual reward rate now, that could change depending on how the market is doing. Most platforms for staking do reviews of their interest rewards every so often.

Even though Polkadot’s system for staking is very safe, there are some risks involved in choosing the validators. For example, if validators break the rules, Polkadot may punish them by cutting (slashing) their stake. This means that stakers may lose some of the DOT they staked.

Because of slashing, those who nominate must be very careful when choosing validators. They should only choose validators that have been reliable in the past. Also, DOT has an unbonding period of 28 days, which means that stakers must wait at least 28 days before getting their tokens. In a market that changes a lot, that can be a bad thing.

If a chosen validator doesn’t respond at all during a session, that validator’s bond will be forced to chill, and that validator may not be available to be chosen in the next session. During the chilling session, the validator will also not get any rewards.

When people put DOT on a software wallet, the safety of the wallet is only as good as the safety protocols of the wallet provider. That is out of Polkadot’s safety range and could be hacked by someone outside of its control.